Elevate Your Knowledge with Bagley Risk Management

Elevate Your Knowledge with Bagley Risk Management

Blog Article

Understanding Animals Risk Protection (LRP) Insurance: A Comprehensive Guide

Browsing the world of animals risk protection (LRP) insurance can be an intricate endeavor for numerous in the farming industry. From just how LRP insurance functions to the different coverage options readily available, there is much to discover in this comprehensive guide that might possibly shape the way animals producers approach danger administration in their companies.

Just How LRP Insurance Works

Occasionally, understanding the mechanics of Livestock Risk Defense (LRP) insurance coverage can be complicated, yet breaking down how it functions can supply clearness for farmers and herdsmans. LRP insurance coverage is a danger administration tool developed to secure livestock manufacturers versus unforeseen rate declines. It's essential to note that LRP insurance is not a profits assurance; instead, it focuses only on cost threat protection.

Qualification and Coverage Options

When it comes to coverage choices, LRP insurance policy provides manufacturers the adaptability to select the coverage level, insurance coverage duration, and recommendations that ideal fit their threat administration requirements. By comprehending the qualification standards and coverage options available, livestock manufacturers can make informed decisions to handle danger successfully.

Advantages And Disadvantages of LRP Insurance Policy

When assessing Livestock Danger Defense (LRP) insurance coverage, it is vital for livestock manufacturers to evaluate the disadvantages and advantages integral in this risk monitoring device.

One of the key advantages of LRP insurance policy is its ability to give security against a decline in animals costs. Furthermore, LRP insurance coverage uses a level of adaptability, allowing manufacturers to tailor coverage degrees and plan periods to match their specific requirements.

One constraint of LRP insurance policy is that it does not shield against all kinds of threats, such as condition outbreaks or all-natural catastrophes. It is critical for manufacturers to thoroughly evaluate their individual threat exposure and monetary situation to determine if LRP insurance policy is the best risk management tool for their operation.

Understanding LRP Insurance Premiums

Tips for Making Best Use Of LRP Advantages

Making best use of the advantages of Animals Risk Protection (LRP) insurance policy requires tactical preparation and aggressive danger administration - Bagley Risk Management. To make the most of your LRP protection, consider the following ideas:

Regularly Evaluate Market Problems: Remain informed about market fads and rate variations in the livestock sector. By keeping an eye on these factors, you can make educated decisions regarding when to acquire LRP insurance coverage to protect versus possible losses.

Establish Realistic Protection Levels: When picking protection levels, consider your production expenses, market worth of animals, and possible risks - Bagley Risk Management. Setting reasonable coverage degrees makes sure that you are appropriately protected without paying too much for unneeded insurance policy

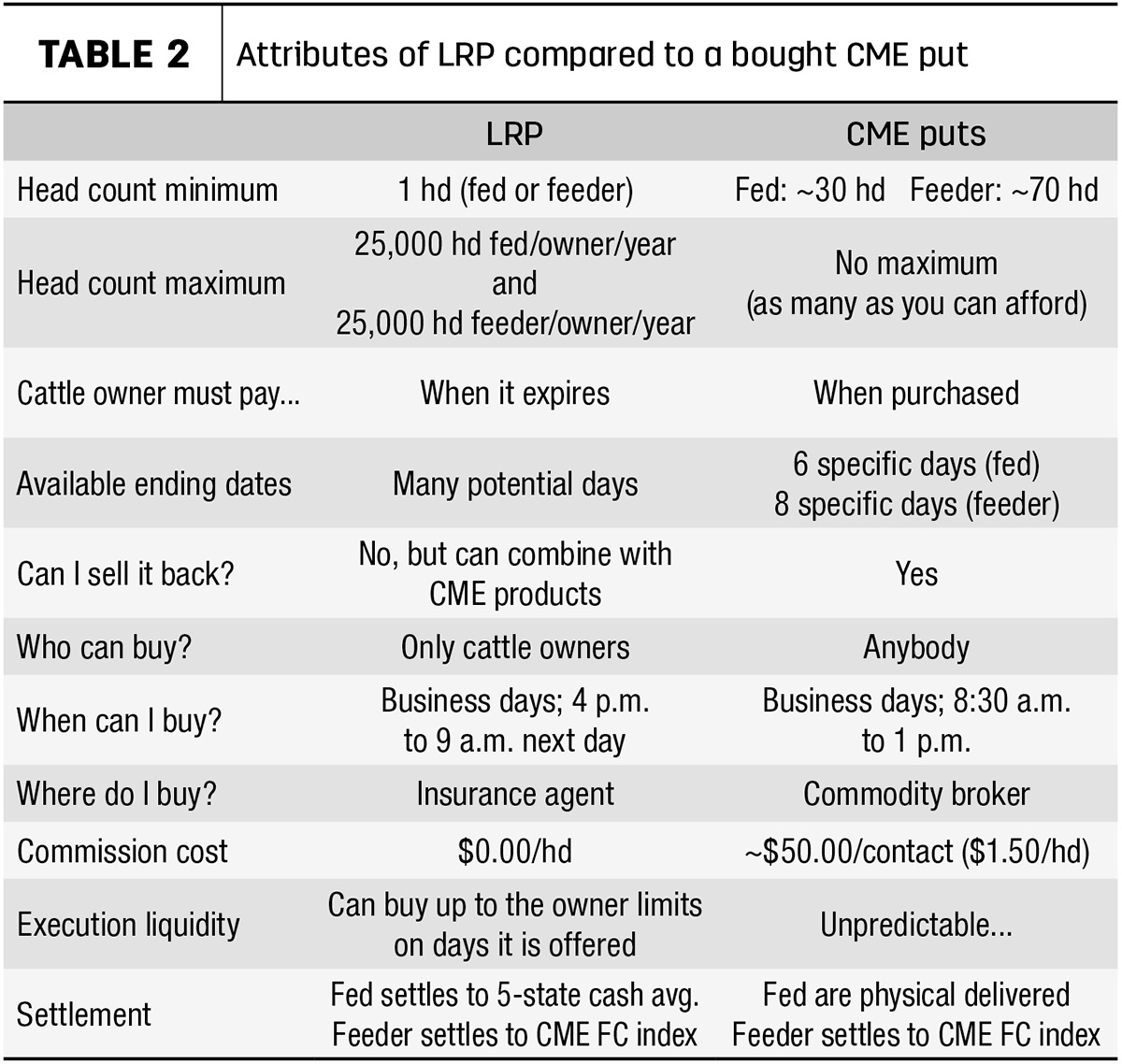

Diversify Your Coverage: Rather than relying only on LRP insurance policy, take into consideration expanding your threat management strategies. Incorporating LRP with various other danger administration devices such as futures contracts or options can provide detailed protection against market uncertainties.

Testimonial and Readjust Protection On a regular basis: As market problems transform, regularly assess your LRP coverage to ensure it straightens with your present risk direct exposure. Readjusting protection degrees and timing of purchases can help maximize your danger protection strategy. By following these pointers, you can make best use of the benefits of LRP insurance policy and guard your animals procedure versus unanticipated dangers.

Verdict

To conclude, animals risk protection (LRP) insurance coverage is a valuable device for farmers to handle the economic risks connected with their animals operations. By understanding just how LRP works, qualification and coverage options, along with the benefits and drawbacks of this insurance policy, farmers can make informed decisions to protect their incomes. By carefully thinking about LRP costs and applying methods to maximize benefits, farmers can mitigate possible losses and ensure the sustainability of their procedures.

Animals producers interested in obtaining Livestock Threat Protection (LRP) insurance coverage can explore an array of qualification standards and insurance coverage options customized to their particular livestock operations.When it comes to protection choices, LRP insurance uses manufacturers the versatility to choose the insurance coverage his comment is here level, coverage period, and endorsements that ideal fit their threat administration requirements.To comprehend the details of Animals Risk Defense (LRP) insurance coverage fully, comprehending the elements affecting LRP insurance policy premiums is essential. LRP insurance costs are established by numerous aspects, including the coverage level chosen, the anticipated cost of livestock at the end of the coverage duration, the kind of livestock being guaranteed, and the size of find out this here the insurance coverage period.Testimonial and Change Coverage On a regular basis: As market conditions transform, occasionally assess your LRP protection to guarantee it straightens with your present danger exposure.

Report this page